We’re halfway through 2019 which gives us a good opportunity to take a look at our financial checklist for the year and see how we’re doing. Okay, we’re a little more than halfway through 2019. That’s my bad, I’ve been a little busy.

The important point is that a once a year check-in of your finances is not enough. A lot can happen over a 12-month period and it’s not enough to just take a look every December to see what’s been going on with your money.

The summer, when we’re more relaxed, on vacation, and not in school, offers a perfect opportunity to analyze our finances.

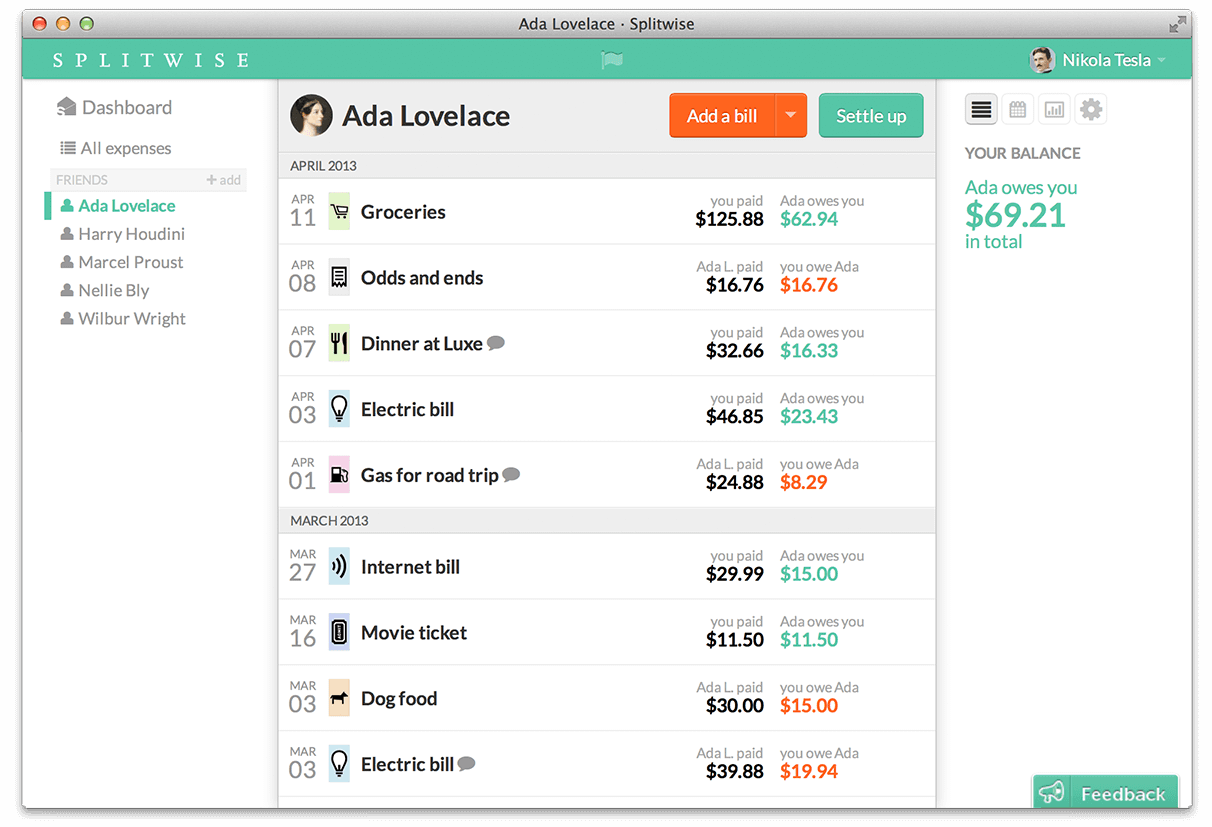

Note that there’s a difference between taking a look at your finances and taking a look at your budget. Your finances encompass all of your accounts: your retirement accounts, investment accounts, budget, credit cards and credit scores, flexible spending accounts, etc. For example, you don’t need to check on your credit score every week, or even every month. You should, however, take a look at your budget every month, how much money is flowing in and flowing out. How much you spent vs. how much you took in.

Now, with that out of the way, let’s talk about what a mid-year financial checklist should actually look like.

1) GOAAAAAAAAAAALs

At the beginning of the year, you hopefully took a look at your finances and your accounts and said to yourself, this is what I want to happen with my accounts by the end of the year, like:

- Increase my net worth by 10%

- Up my 401(k) contribution amount to 15%

- Pay off all of my credit card debt

- Save up enough money to pay for my three-week vacation to Hawaii

Or something like that. The half-way point of the year is a great time to see if you’re half-way to your goals for the year. Maybe you’ve only paid off 30% of your credit card debt. This could be a good reminder to increase the amount you pay off your credit card every month. Or maybe you’re still just paying the minimum due on your balance. Knowing that your goal is 15%, this is a good point to remind yourself to keep going towards your goal.

2) Da budget

Wait, you just said your budget is something you should like at at the end of every month, now you’re telling me to look at it in the middle of the year as well?

Yes, but in a different way.

At the end of every month, sit down and look at how much money you took in in that month and how much money you spent and then move on with your life.

On the other hand, the half-way point of the year is when you should take a look at your spending habits over the last six months. Maybe you consistently spend more on eating out than you’ve budgeted for, but less on entertainment. Consider transferring some money in your budget from one bucket to the other. Or maybe you’re underspending on groceries and don’t need to allocate that much money every month to your grocery bill.

Analyze your budget and spending over the last six months and move money around in your budget accordingly.

3) Retire away!

The half-way point of the year is also a great time to take a look at your retirement accounts and see how you’re doing.

Your account should be automatically rebalancing your investments for you. That means that if you’re distributing 40% of your contributions into a large-cap (big company) stocks, your 401(k) account should be roughly 40% that fund. If it’s not, it could be time to rebalance your account.

And if you have leftover money in your budget every month, the half-way point of the year is a good time to increase your contribution amounts.

4) Quick check of your other investments

Check in on your non-retirement investment accounts as well and see how they’re doing. Look at your balance of stocks, bonds, and other investments like gold and real estate and make sure you’re where you want to be . If your balance is out of whack, then this is a good point in the year to move money around between different asset classes.

Even within a specific asset class, like stocks, your portfolio could be out of balance as well. Maybe one of your stocks has done really well in the first half of this year and now represents 25% of your portfolio. That’s probably too much for one specific stock, so it might be time to sell some of that stock and move the money into something else.

5) Make a plan, Stan

Now that you’ve reviewed your goals, your investments, and your budget, the mid-point of the year is a great time to analyze the plan you made at the end of last year and make any changes if necessary. It could be that you’re right on track and don’t need to make any changes, but more likely you’ll need to tweak a few things here or there. Feel good knowing where you are and make a plan to finish the second half of the year strong.

It’s worth it

Goals, investments, retirement, budget, and plan. Those are the five things you should take a look at in your mid-year checkup of your finances. Doing this in the middle of the year, and not waiting until the end of every year is worth it as you’ll put yourself in a better position for financial success in life.